REVVITY (RVTY)·Q4 2025 Earnings Summary

Revvity Beats Q4 on EPS Strength as Diagnostics Drives Upside

February 2, 2026 · by Fintool AI Agent

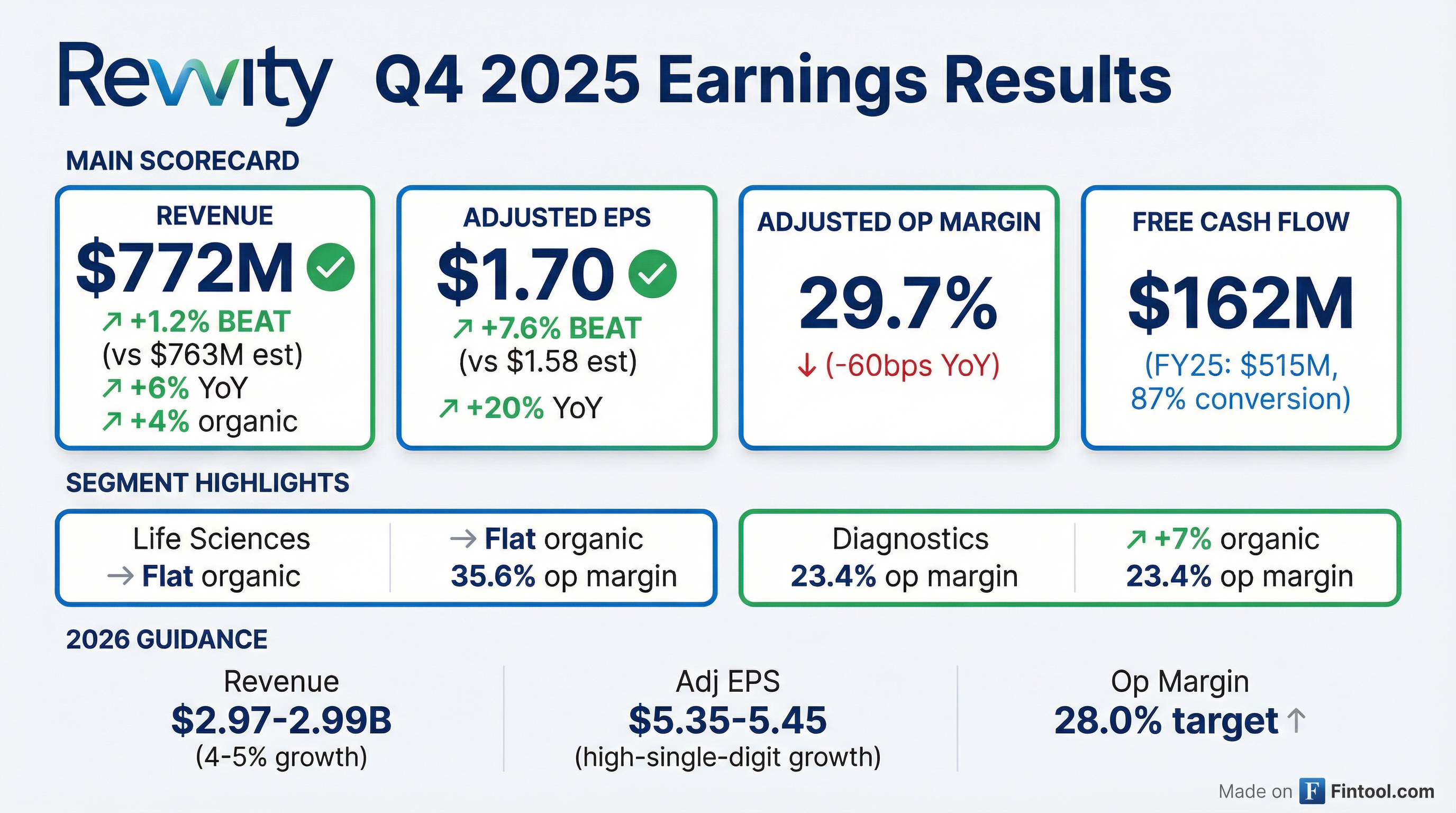

Revvity delivered a solid Q4 2025 with adjusted EPS of $1.70, beating consensus by 7.6%, driven by stronger-than-expected diagnostics performance and a favorable 6.5% tax rate. Revenue of $772M grew 6% reported (+4% organic), topping estimates by 1.2%. The company guided 2026 EPS of $5.35-$5.45 on 2-3% organic growth, with management expressing cautious optimism on improving pharma/biotech trends.

Did Revvity Beat Earnings?

Yes. Revvity beat on both the top and bottom line:

The EPS beat was amplified by a lower-than-expected tax rate (6.5% vs. typical ~15%) due to timing of discrete items, and lower adjusted net interest expense of $23M. Full-year adjusted EPS of $5.06 exceeded the high end of initial guidance, representing 3% growth YoY.

What Did Management Guide?

Revvity issued 2026 guidance that implies high-single-digit EPS growth:

Key assumptions embedded in guidance:

- FX tailwind of +1%, M&A contribution of +75bps (ACD/Labs closed mid-January, adds ~$20M revenue)

- Adj. net interest expense of ~$95M (higher YoY due to EUR500M bond maturing July 2026)

- 18% normalized tax rate vs. 14.5% in FY25 — no discrete tax benefits assumed

Q1 2026 Guidance:

Extra week impact (14 operating weeks in Q1): +100bps to organic growth, but -$0.06 EPS headwind due to extra week of labor costs. Revenue benefit mainly from life sciences reagents and software contract amortization.

Management characterized the 2-3% organic growth framework as "prudent" given macro uncertainty, with multiple paths to upside if pharma/biotech trends continue improving.

What Changed From Last Quarter?

Improved:

- Pharma/biotech demand: Reagents outperformed expectations with +LSD growth from pharma/biotech customers

- Immunodiagnostics ex-China: Grew high-single-digits in Q4, sustaining high-single-digit full-year growth outside China

- Reproductive Health: Newborn screening delivered mid-single-digit growth despite declining birth rates

- High-content screening: Double-digit growth in Q4, expected momentum to continue in 2026

- Cash generation: FY25 free cash flow conversion hit 87% of adjusted net income, up from historical ~70%

Headwinds:

- Academic/government: Continued low-single-digit decline, no budget flush observed

- Instruments: Improved sequentially but still lagging reagent recovery; management expects flat growth in 2026

- China immunodiagnostics: DRG policy headwinds continue; now expecting down slightly in H2 2026, more conservative than prior low-single-digit growth outlook

- Margin pressure: Tariffs, product mix, and FX weighed on diagnostics margins (-230bps YoY)

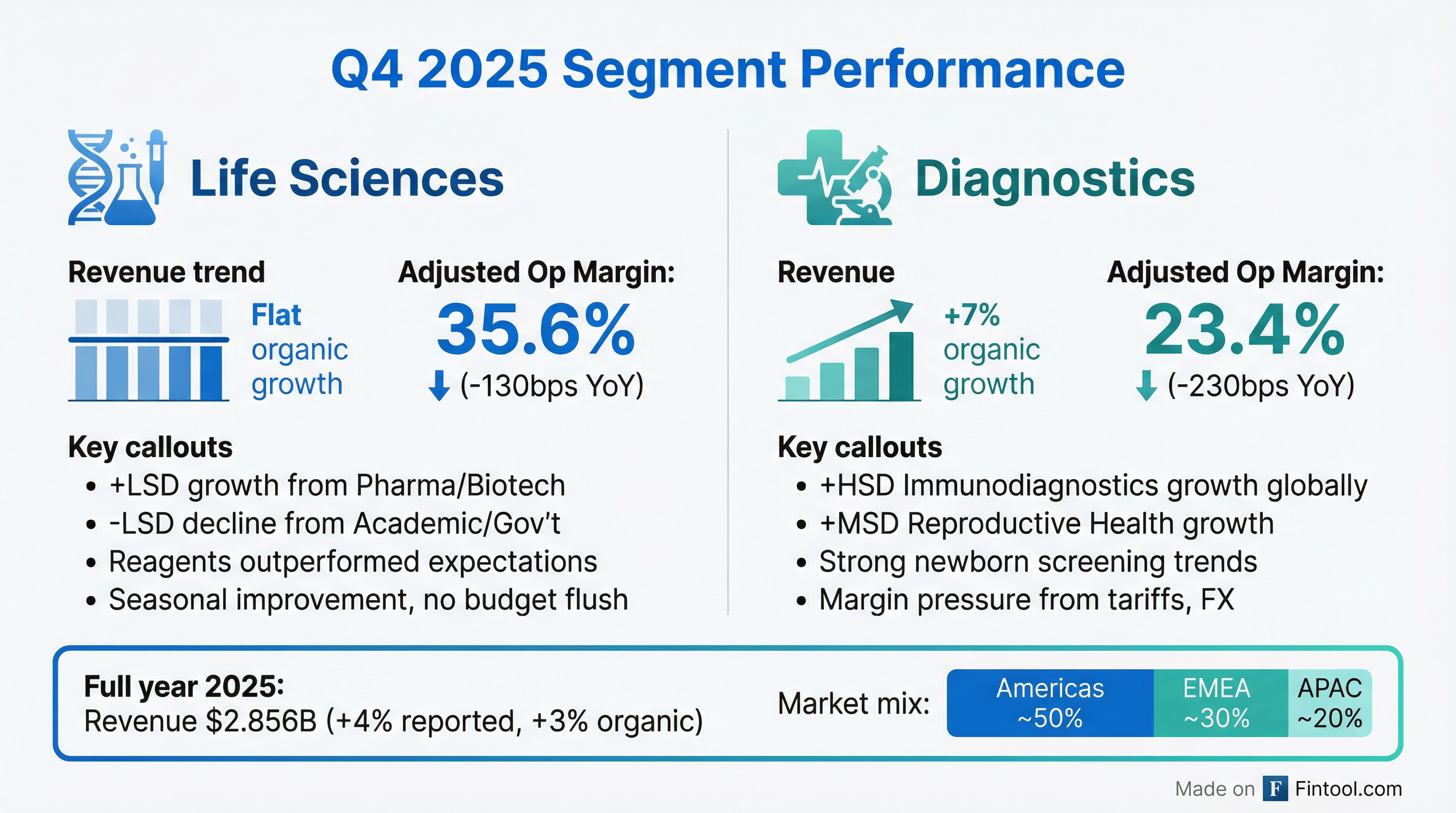

How Did Each Segment Perform?

Life Sciences (50% of revenue)

- Reagents (Life Sciences Solutions) performed better than expected, with pharma/biotech demand improving

- Instruments saw sequential improvement but no year-end budget flush from academic customers; high-content screening grew double-digits

- Signals Software flat in Q4 due to timing of renewals and tough comps (mid-thirties growth last year); full-year +high-teens organic growth

Signals SaaS Metrics:

Diagnostics (50% of revenue)

- Immunodiagnostics: +HSD growth globally driven by strength outside China; ex-China business expected to grow high-single-digits in 2026

- Reproductive Health: +MSD growth in newborn screening despite global birth rate declines

- Margin drag: Tariffs, unfavorable product mix, and FX offset volume leverage

Strategic Initiatives: AI and Operational Excellence

Signals Synthetica Launch

Revvity introduced Signals Synthetica, an AI Models-as-a-Service platform for drug discovery, in partnership with Eli Lilly's Tune Lab. Key points:

- Creates a federated marketplace for validated AI/ML models within Signals One platform

- Curates and QA/QCs AI models for bench scientists who aren't computer scientists

- Enables "lab-in-the-loop" drug development: wet lab → in silico modeling → refinement

- Lilly Tune Labs models built on $1B+ of R&D investment over the last decade

- Lilly co-funding Signals access and Synthetica modeling credits for biotech users

CEO Singh called Synthetica "the product launch that excites me the most" and emphasized its transformative potential for preclinical R&D.

Software Long-Term Ambition: Management expects the Signals business to double in revenue over the next 4-5 years (~15% organic CAGR), well above the stated LRP target of 9-11%.

Margin Expansion Roadmap

Management reiterated the path to 28% adjusted operating margin in 2026:

Cost programs expected to be fully completed by end of Q2 2026, with increasing benefit in H2.

Long-range target is mid-30s operating margin through 25bps annual gross margin expansion and 50bps operating leverage.

Capital Deployment

Revvity has been aggressive with buybacks during the end-market downturn:

CFO Krakowiak emphasized the balance sheet remains "strong" with capacity for opportunistic M&A while maintaining investment-grade credit rating.

How Did the Stock React?

Revvity pre-announced preliminary Q4 results on January 12, which drove initial price reaction. Today's full earnings call confirmed the beat with additional detail on segment performance and 2026 guidance.

The stock has rallied from ~$101 pre-announcement to current levels, with muted reaction to today's call as the upside was largely priced in from the preliminary release.

What Should Investors Watch?

Near-term catalysts:

- Pharma/biotech recovery durability — Management needs multiple quarters of consistent improvement before raising organic guidance

- China immunodiagnostics inflection — Now expected to be down slightly in H2 2026; any improvement vs. this conservative assumption would be upside

- Software product launches — Biodesign, Synthetica, and Labgistics launches represent potential upside not fully embedded in guidance

Key risks:

- Academic/government funding remains subdued with no visibility on improvement

- 18% normalized tax rate in 2026 vs. 6.5% in Q4 creates a YoY headwind

- Instrument recovery lagging reagents; management guiding flat growth

- Tariff and FX pressure on diagnostics margins may persist

Q&A Highlights

On M&A appetite (Vijay Kumar, Evercore): Management remains focused on software and life sciences reagents for M&A, but hasn't found targets that meet both strategic and financial return criteria. A "merger of equals" is theoretically on the table but only if it makes strategic sense — "not just for size and scale."

On China IDX outlook (Dan Leonard, UBS): CFO Krakowiak clarified that guidance now assumes China immunodiagnostics will be "down slightly" in H2 2026, more conservative than prior expectations of low-single-digit growth. This represents <5% of total company revenue.

On free cash flow (Brandon Couillard, Wells Fargo): FCF conversion has improved from ~70% historically to ~90% over the past two years, driven by working capital initiatives, higher recurring revenue mix, and company-wide cash flow targets. LRP calls for 85%+ conversion.

On reagent competitive dynamics (Tycho Pedersen, Jefferies): Management pushed back on concerns about discounting pressure from peers: "We've taken share... We've not seen any margin dilution per se on the reagents business."

Key Management Quotes

"I would be bold enough to say... we would be really disappointed if this business does not at least double in revenue over the next 4-5 years, which would imply something closer to a 15% organic growth rate." — Prahlad Singh, CEO on Signals software

"A lot more clarity and confidence in policy and regulatory environment enables our pharma biotech customers to plan appropriately and with more degree of confidence as we get into 2026." — Prahlad Singh, CEO

"Synthetica provides a federated model where you are able to curate, put AI models on one platform that are validated, and be able to use them and enable drug discovery to happen in an accelerated form." — Prahlad Singh, CEO

"We've taken share... We've not seen any margin dilution per se on the reagents business, and it continues to do well for us." — Prahlad Singh, CEO

Related Links: